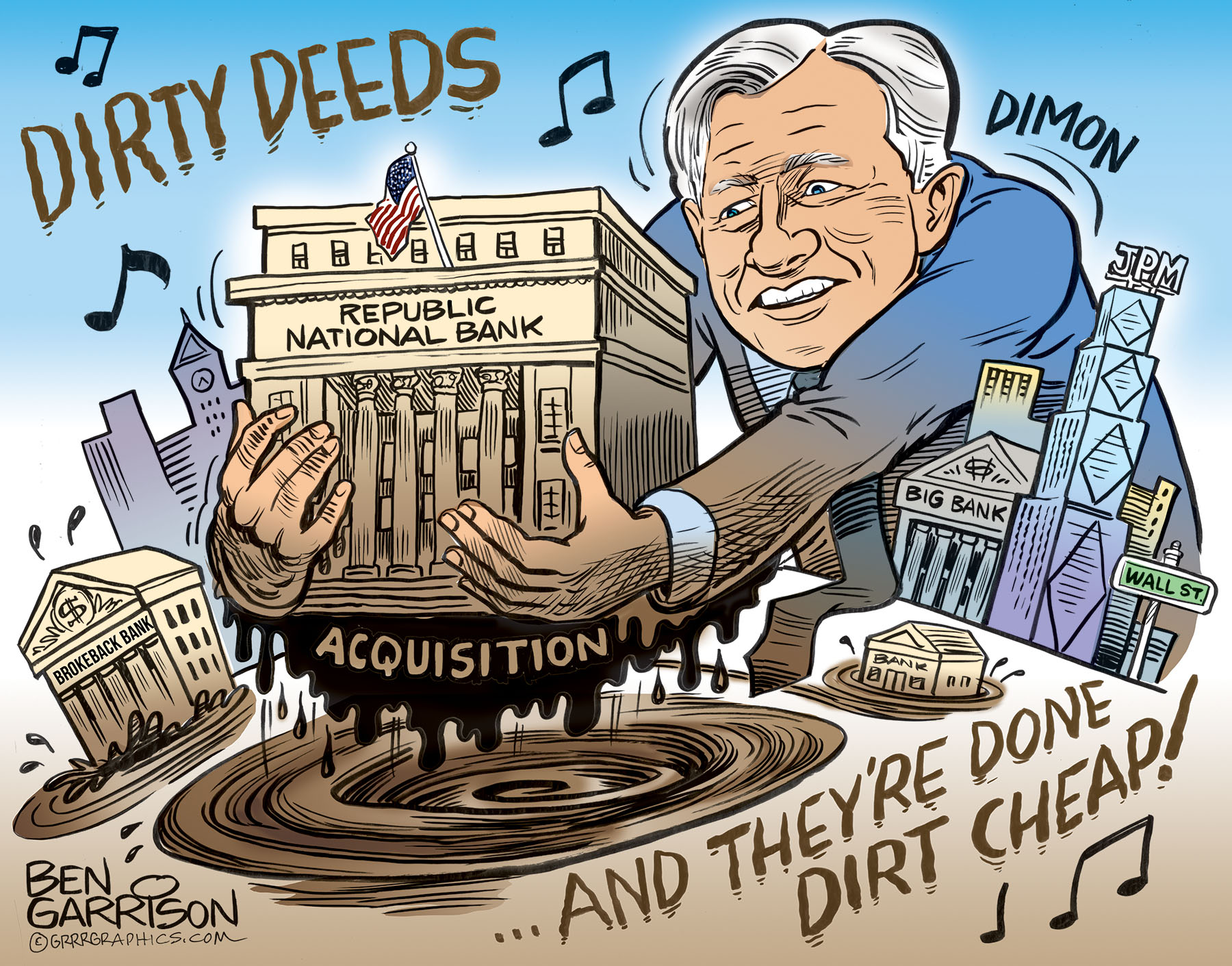

“Dirty Banking Deeds Done Dirt Cheap”

Cartoon published 05/04/2023*

*We at GrrrGraphics endeavor to produce timely cartoons, but due to extenuating circumstances this one is a couple of days late. It still pertains because the banking crisis is not going away and it will worsen.

Yesterday the Fed raised interest rates once again, which will pressure smaller banks still further because many of their ‘investments’ are now underwater. Such banks are going broke and the big bank sharks will continue to pick off the assets and deposits of many of them. In other words, big banks will become even bigger and that’s not good. Monopoly men at the top want consolidation which means depositors will have less choice. Eventually there will be no choice at all and everyone will be forced to accept the globalist currency—the dreaded central bank digital currency (CBDC). It will bring about more control over what we can buy and sell and our privacy will become a thing of the past. All transactions will be scrutinized, tracked, taxed, controlled, rewarded, or penalized.

Never Miss A New Cartoon! Sign Up Today For Our GrrrNEWS cartoon newsletter-It’s Free and Easy!

The latest example of the centralization of the banking system again involved Jamie Dimon’s megalith bank JP Morgan. It’s a very big fish (shark, actually) that gobbles up smaller fish. They recently ‘acquired’ First Republic Bank. Not only did they gobble up all 84 branches, $229 billion in assets, and $103 billion in deposits, the FDIC actually rewarded JP Morgan with a $13 billion bonus—paid for by the taxpayers, of course. This is reminiscent of the 2008 ‘too big to fail’ bank bailout where taxpayers were forced to pay trillions to mega banks and the bankers got their bonuses first. Yes, they were rewarded for being criminals. They sold packaged real estate derivatives at high ratings when they knew they were junk.

Back in 2008, we still lived near Seattle. JP Morgan ‘acquired’ our bank at the time: Washington Mutual. They had been after WM for a while, but managed to scoop it up at an under-market value price when many banks were hurting the most. JP Morgan stole WM, who later sued JP Morgan for unfair practices. Washington Mutual lost. It’s tough to chalk up a win against such powerful big banks who remain unaccountable for bending or breaking the law.

The law was certainly bent in favor of JP Morgan when they assimilated First Republic. A 1993 banking act was designed to protect us against the monopolization of the banking industry. Banks are not allowed to own over 10 percent of the market, but the corrupt and compromised FDIC ‘bent’ the law in favor of JP Morgan. I heard an ‘expert’ on CNBC state it’s important to allow JP Morgan to acquire First Republic because otherwise a bigger crisis could have been triggered. This is the same old ’too big to fail’ canard and fear mongering that plays into the hands of the big banks. The corrupt banking system should have been forced to collapse in 2008 along with the Federal Reserve. We could have let it all burn and out of the ashes we might have seen the rise of a sound money system based on gold and silver

Currently there are over 200 smaller banks with over $2 trillion in unrealized losses on their books. This will worsen as the Fed continues to raise rates. There are a lot more banks waiting to be ‘consolidated.’ The big banks are able to avoid scrutiny. They are not accountable. They are untouchable.

They continue to get away with dirty deals and they do them ‘dirt cheap.’

— Ben Garrison

Follow Ben Garrison cartoons on Twitter at @grrrgraphics2

Follow @grrrgraphics on Twitter GAB, TRUTH SOCIAL, PARLER, INSTAGRAM, TELEGRAM ,

or join us at The Garrison!